The United States Of Debt

|

Total Debt In America Hits A New Record High Of Nearly 60 Trillion DollarsFrom The Economic Collapse

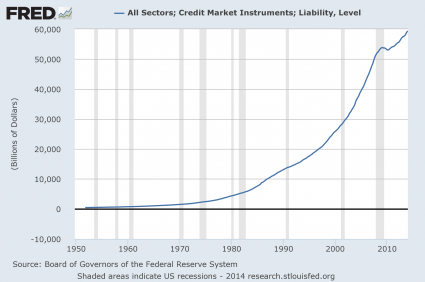

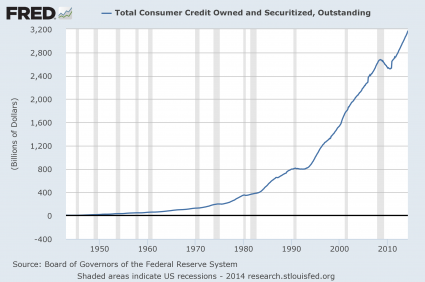

When the last recession hit, total debt in America actually started going down for a short period of time. But then the Federal Reserve and our politicians in Washington worked feverishly to reinflate the bubble and they assured everyone that everything was going to be just fine. So Americans once again resorted to their free spending ways, and now total debt in the United States is rising at almost the same trajectory as before and has hit a new all-time record high. We see a similar thing when we look at a chart for consumer debt in America...

...the remainder...

FROM The Coming Global Wars Will End the U.S. Empire

|

FROM Gov’t Seizes Control of All Your Financial AccountsEveryone knows that the United States has gone bankrupt. As the U.S. government and the Fed poured trillions of dollars of YOUR money into the banks and markets after the 2008 economic collapse, this unprecedented level of money-printing is catapulting the U.S. debt to $28 trillion by 2018. But now, the U.S. government and the Fed are completely out of ammo. They desperately need money to maintain their own power, and taxes are no longer enough. So in order to keep the Ponzi scheme going, the U.S. government has made several highly controversial moves to be in position to seize control of all your financial accounts. And it’s becoming clearer by the day, if you want to protect your savings and wealth from government confiscation, you only have ONE choice.

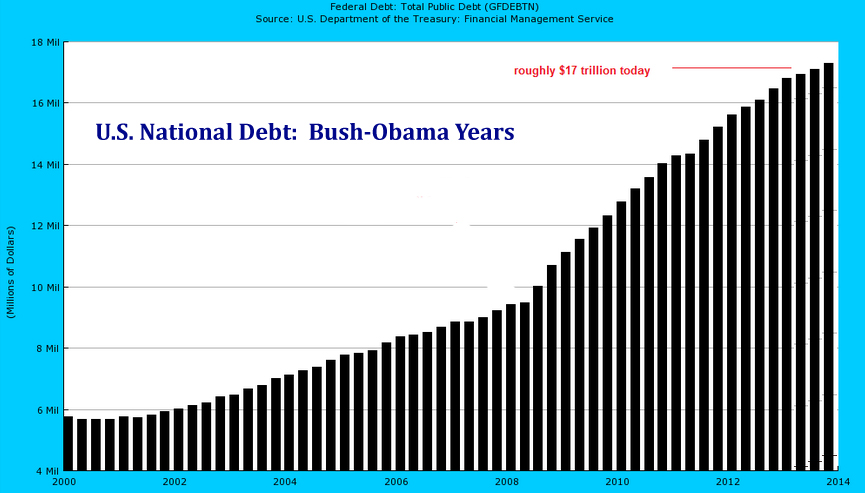

What happens when America goes bankrupt? The $17 Trillion question? Let’s be clear, America is already bankrupt. “Bankrupt” is defined as “any insolvent debtor” – a debtor whose liabilities exceeds its assets. The U.S. government, by its own admission, is a bankrupt entity. Not bankrupt “soon,” bankrupt NOW. To the tune of just OVER $17 trillion. In an attempt to fabricate the illusion of “growth,” the Fed and their bank-owned politicians poured trillions of dollars of YOUR money into big banks and the markets in order to prop up stocks, bonds and real estate after the 2008 economic collapse. The idea was to “fix” the economy by pouring 1,000 gallons of high-octane debt-gas on an already ragging debt-fueled bond fire. Of course, REAL growth never materialized. Instead, all that these criminals managed to accomplish with their money-printing was to blow up new bubbles, widen the income divide, and dramatically increase the wealth of a select few at the expense of the rest of us. The tragic result: the USA’s liabilities now exceed its assets by an amount so astronomical it’s almost incomprehensible. And by its own admission, that hole will be getting deeper each year until we reach $28 trillion in debt by 2018. Or until the Ponzi scheme blows up. FROM Global Banking System on the Verge of CollapseAs the axiom goes, “Those who ignore history are doomed to repeat it.” And since our politicians, bankers and citizens have ignored the horrifying events of just 6 years ago, the United States and the rest of the world are about to repeat history in record time. Recent data now confirms our worst fears: the factors that led to the 2008 collapse of the banking system are back with a vengeance. Only this time, it’s much worse than anyone imagined. With the insidious help of politicians and The Fed, banks have secretly built up over $30 TRILLION worth of the same toxic assets that destroyed our economy in 2008. But this time, when the entire house of cards comes crashing down, neither the U.S. government or the Federal Reserve have the resources to bail out the banks and prop up the stock market. Thus, experts now warn: The global banking system is on the verge of collapse! And there’s only ONE asset that can protect you. |

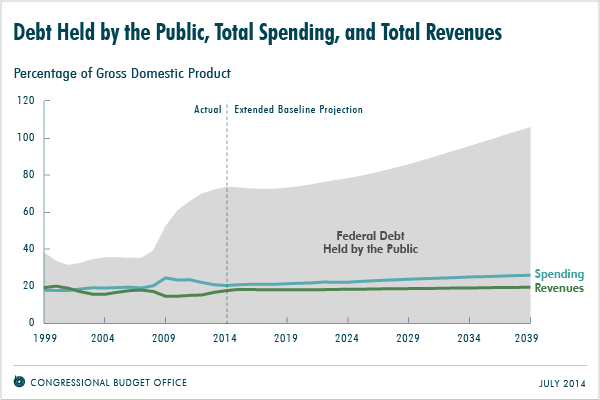

FROM CBO

What Is the Outlook for the Budget in the Long Term?

CBO has extrapolated its baseline projections through 2039 (and, with even greater uncertainty, through later decades) by producing an extended baseline that generally reflects current law. The extended baseline projections show a substantial imbalance in the federal budget over the long term, with revenues falling well short of spending (see the figure below). As a result, budget deficits are projected to rise steadily and, by 2039, to push federal debt held by the public up to a percentage of GDP seen only once before in U.S. history (just after World War II). The harm that such growing debt would cause to the economy is not factored into CBO’s detailed long-term projections but is considered in further analysis presented in this report.

Federal spending would increase to 26 percent of GDP by 2039 under the assumptions of the extended baseline, CBO projects, compared with 21 percent in 2013 and an average of 20½ percent over the past 40 years. That increase reflects the following projected paths for various types of federal spending if current laws remained generally unchanged (see the figure below):

How USA Residents Are Screwed! |

FROM Project to RESTORE AMERICAThe FairTax is a consumption tax unilaterally applied to all Americans at the same rate. For businesses, payroll taxes would no longer exist. Our exports would include a heavy tax for overseas buyers purchasing our products, while our imports would be cheaper for us to purchase. I'm not sure how this would affect GDP, as more information is necessary.  According to the FairTax website, "Under the FairTax, every person living in the United States pays a sales tax on purchases of new goods and services, excluding necessities due to the prebate." The prebate gives every legal resident household an "advance refund" at the beginning of each month so that purchases made up to the poverty level are tax-free. So a family of four making something like $50,000/year should not have to pay taxes, thus preventing an unfair burden on low-income families. Since the FairTax eliminates both federal and payroll taxes, you get to keep your gross pay amount of each paycheck earned.

|

What would you say if I told you that Americans are nearly 60 TRILLION dollars in debt? Well, it is true. When you total up all forms of debt including government debt, business debt, mortgage debt and consumer debt, we are 59.4 trillion dollars in debt. That is an amount of money so large that it is difficult to

What would you say if I told you that Americans are nearly 60 TRILLION dollars in debt? Well, it is true. When you total up all forms of debt including government debt, business debt, mortgage debt and consumer debt, we are 59.4 trillion dollars in debt. That is an amount of money so large that it is difficult to