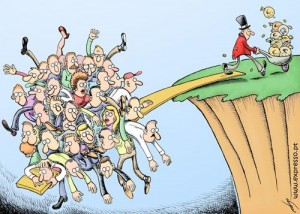

Bar Stool Economics:A Simple Guide to the American System of Taxation and DistributionMac Slavo |

Uncle Sam, the thief, taking citizens for a ride!!!

|

|

Suppose that every day, ten men go out for a beer and the bill for all ten comes to $100. If they paid their bill the way we pay our taxes, it would go something like this:

So that’s what they decided to do. The men drank in the bar every day and seemed quite happy with arraignment, until one day, the owner threw them a curve. "Since you are all such good customers, he said, I’m going to reduce the cost of your daily beer by $20.00." Drinks for the ten men now cost just $80.00 The group still wanted to pay their bill the way we pay our taxes so the first four men were unaffected. They would still drink for free. But what about the other six men – the paying customers? How could they divide the $20 windfall so that everyone would get there "fair share?” They realized that $20.00 divided by six is $3.33. But if they subtracted that from everybody’s share, then the fifth man and the sixth man would each end up being paid to drink his beer. So, the bar owner suggested that it would be fair to reduce each man’s bill by roughly the same amount, and he proceeded to work out the amounts each should pay! And so:

Each of the six was better off than before! And the first four continued to drink for free. But once outside the restaurant, the men began to compare their savings. "I only got a dollar out of the $20" declared the sixth man. He pointed to the tenth man, " but he got $10!” "Yeah, that’s right, shouted the seventh man. "why should he get $10 back when I got only two? The wealthy get all the breaks!” "Wait a minute,” yelled the first four men in union. " We didn’t get anything at all. The system exploits the poor!” The nine men surrounded the tenth and beat him up. The next night the tenth man didn’t show up for drinks, so the nine sat down and had beers without him. But when it came time to pay the bill, they discovered something important. They didn’t have enough money between all of them for even half of the bill! And that, boys and girls, journalist and college professors, is how our tax system works. The people who pay the highest taxes get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up anymore. In fact, they might start drinking overseas where the atmosphere is somewhat friendlier. For those who understand, no explanation is needed. For those who do not understand, no explanation is possible. Hat tip Brother Slavo via David R. Kamerschen, Ph.D. The original author of this simple guide is unknown. [Editor's Note: The story doesn't quite end this way...when the remaining nine men realized that they didn't have enough money to pay the bill, one of the men (name was Ben) said, "I have the extra bucks right here! I printed them last night in my basement."

|