The Federal Government Does Not Have a Debt Problem!

SEE THIS AS INTERNET PAGE

|

How did the feds get to a $16.8 Trillion debt? OBVIOUSLY, because the feds borrow $1.5 trillion (bills, notes, bonds) annually. The annual borrowed debt is in addtition to $2.4 trillion in pirated revenue from over-taxed citizens. [Editor: Replace socialist income tax with National Sales Tax] The Federal Reserve buys 64% of the debt floated at government auctions and injects the cash into the US treasury, thereby inflating the dollar and causing price increases. Former White House Director of Management & Budget David Stockman Warns of Crash From 'Unsustainable' Fed-Fueled Bubble in this article. How did the feds get to a $16.8 Trillion debt? OBVIOUSLY, because the feds borrow $1.5 trillion (bills, notes, bonds) annually. The annual borrowed debt is in addtition to $2.4 trillion in pirated revenue from over-taxed citizens. [Editor: Replace socialist income tax with National Sales Tax] The Federal Reserve buys 64% of the debt floated at government auctions and injects the cash into the US treasury, thereby inflating the dollar and causing price increases. Former White House Director of Management & Budget David Stockman Warns of Crash From 'Unsustainable' Fed-Fueled Bubble in this article.

|

&

The housing boom

We must back up a step. The meltdown was the consequence of a combination of easy money and low interest rates engineered by the Federal Reserve and easy housing engineered by a variety of U.S. government agencies and policies, including HUD; the Federal Housing Authority; and two nominally private “government-sponsored enterprises” (GSEs), Fannie Mae (the Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation). The agencies, along with enactments such as the Community Reinvestment Act (passed in the 1970s then fortified in the Clinton years), which required banks to make loans to people with poor and nonexistent credit histories, made widespread home ownership a national goal. All that, fueled by Fed-induced cheap credit, led to a home-buying frenzy and an explosion of subprime and other nonprime mortgages, which banks and the GSEs bundled into securities and peddled to investors worldwide. (The GSEs bought and guaranteed a huge number of those mortgages originated by banks and mortgage companies, some of which it sold as mortgage-backed securities and some of which it held on its own balance sheet.)

AND...fast-forward to 2013, Obama, et.al. believe that TOO many young people and people with poor credit need help to buy a house, so let's screw the economy and the housing market all over again.

|

July 15, 2013 by Bob Livingston

The U.S. government is a criminal enterprise and is out of control. The U.S. Constitution was drafted to limit government and affirm the natural rights held by the people, but it is serially ignored and violated by the President, the Congress, the Supreme Court and law enforcers both Federal and local.

The result is growing tyranny and a police state and a Nation that is becoming a simmering cauldron of unrest — sparked by the passage of unConstitutional laws by a Congress controlled by moneyed interests; the affirming of those laws by the Supreme Court; long-term high rates of unemployment; a declining standard of living; increased regulation by unaccountable, bought-and-paid-for psychotic government functionaries; money printing; a presstitute mass media; [Editor's Note: love that word!] increasingly militarized and militant local law enforcement officers; and a declining morality encouraged by both the political and celebrity classes — that is poised to explode.

The elected class and their handlers have been at war with the American people, the Constitution and the American way of life for many years. In the beginning, they used gradualism to sneak small abuses by an unobservant public. But as the unConstitutional encroachments gained ground, they accelerated. We are now rapidly heading toward a calamitous event that will rock the system to its core and, hopefully, restore us to Constitutional governance.

|

|

...Rather than cut the size of their government and reduce their borrowing, the Japanese have taken a page from Fed Chairman Ben Bernanke's playbook. Japan's central bank has been printing huge sums of money. And it's been buying government debt to help finance the country's huge deficits (which equal 10% of its gross domestic product).

Keep in mind, interest rates on 10-year Japanese bonds were already well below 0.5%. The result of this enormous money and credit stimulus was predictable: Stock prices have gone up (at least temporarily). And consumption has increased since people would rather spend money now before prices start going up. The problem, of course, is that when you're bankrupt and you begin to deliberately destroy the value of your currency, everyone begins to sell it. The yen is collapsing. And Japan has begun to suffer a trade deficit for the first time in living memory. Investors are now fleeing the Japanese bond market in a near panic.

.png)

Finally, we see the Keynesian lie laid bare. Japan's efforts to "stimulate" its economy with unlimited government borrowing and central-bank printing aren't working out so well for anyone who lent the poor bastards any money. We've been warning of this ultimate end game since 2008. It's the same scenario we've described as the "End of America" because the U.S. dollar undergirds the entire global system of sovereign credit/paper money.

What caused the panic in Japan is simple to understand. For the first time in modern history, Japan began to run a serious trade deficit, forcing it to get foreign financing for its government bonds. It's easier for America to get foreign financing because more than 60% of the world's bank reserves are held in dollars. It's much harder for the Japanese to get foreigners to invest in a bankrupt government that's printing money as fast as it can. No wonder, right?

The point you've got to remember is that America will only keep this privilege as long as it's solvent. Not many people understand that limitation today. And that's why I'm so worried.

|

|

If the American people truly understood how the Federal Reserve system works and what it has done to us, they would be screaming for it to be abolished immediately. It is a system that was designed by international bankers for the benefit of international bankers, and it is systematically impoverishing the American people. The Federal Reserve system is the primary reason why our currency has declined in value by well over 95 percent and our national debt has gotten more than 5000 times larger over the past 100 years. The Fed creates our "booms" and our "busts", and they have done an absolutely miserable job of managing our economy. But why do we need a bunch of unelected private bankers to manage our economy and print our money for us in the first place? Wouldn't our economy function much more efficiently if we allowed the free market to set interest rates? And according to Article I, Section 8 of the U.S. Constitution, the U.S. Congress is the one that is supposed to have the authority to "coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures". So why is the Federal Reserve doing it? Sadly, this is the way it works all over the globe today. In fact, all 187 nations that belong to the IMF have a central bank. But the truth is that there are much better alternatives. We just need to get people educated. If the American people truly understood how the Federal Reserve system works and what it has done to us, they would be screaming for it to be abolished immediately. It is a system that was designed by international bankers for the benefit of international bankers, and it is systematically impoverishing the American people. The Federal Reserve system is the primary reason why our currency has declined in value by well over 95 percent and our national debt has gotten more than 5000 times larger over the past 100 years. The Fed creates our "booms" and our "busts", and they have done an absolutely miserable job of managing our economy. But why do we need a bunch of unelected private bankers to manage our economy and print our money for us in the first place? Wouldn't our economy function much more efficiently if we allowed the free market to set interest rates? And according to Article I, Section 8 of the U.S. Constitution, the U.S. Congress is the one that is supposed to have the authority to "coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures". So why is the Federal Reserve doing it? Sadly, this is the way it works all over the globe today. In fact, all 187 nations that belong to the IMF have a central bank. But the truth is that there are much better alternatives. We just need to get people educated.

|

|

It's hard to believe that in the 21st century, educated people believe the government can produce real wealth by creating money. It's especially ironic that the main preachers of this superstition fancy themselves progressives and are the first to accuse their opponents of being against science. What could be more antiscience than the alchemic proposal to create wealth by having the Federal Reserve make entries in a digital ledger? It's more absurd than alchemy: Alchemists claimed they could turn base metals into gold. Inflationists require only thin air.

|

&

|

The US government began the slow evolution from a Constitutional Republic to a quasi-socialist government using Constitutional power to transform the government in the 1930s.

Mr. Obama and the Socialist thieves in CON gress want to increase taxes (increase the theft from citizens' paychecks) for more spending and expansion of the social-welfare state. Expansion of government means even more fraud, waste, make-work jobs and embezzlement.

This video proves that the prez and CON gress have a SPENDING PROBLEM!!! This video shows that John Maynard Keynes was WRONG!

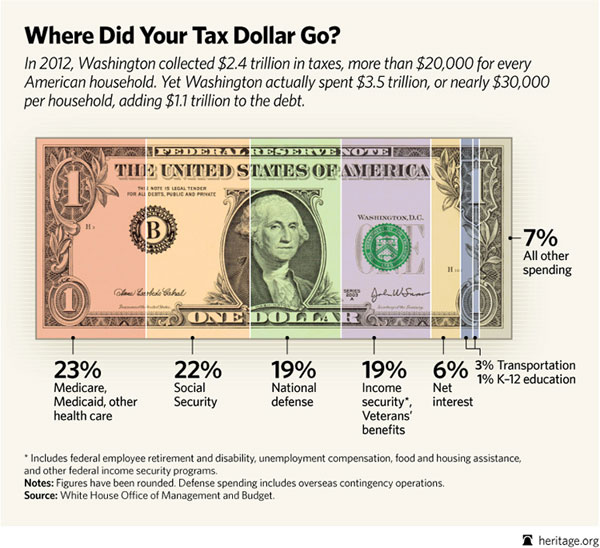

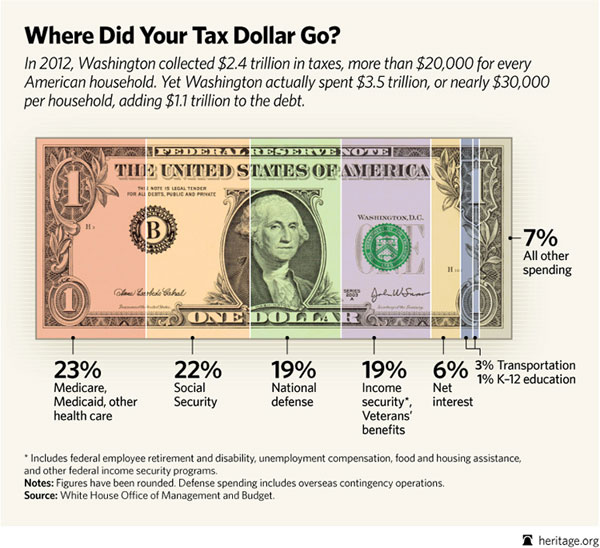

Where the Spending Goes

BUDGET SENSE: Federal Spending by the Numbers - 2012

|

|

Why Do We Need Term Limits?

John Adams said, “Without [term limits] every man in power becomes a ravenous beast of prey”. That being said, here are some of the reasons we believe our country needs Term Limits.

- Term Limits can help break the cycle of corruption in Congress. Case studies show that the longer an individual stays in office, the more likely they are to stop serving the public and begin serving their own interests.

- Term Limits will encourage regular citizens to run for office. Presently, there is a 94% re-election rate in the House and 83% in the Senate. Because of name recognition, and usually the advantage of money, it can be easy to stay in office. Without legitimate competition, what is the incentive for a member of Congress to serve the public? Furthermore, it is almost a lost cause for the average citizen to try to campaign against current members of Congress.

- Term Limits will break the power special interest groups have in Congress.

- Term Limits will force politicians to think about the impact of their legislation because they will be returning to their communities shortly to live under the laws they enacted.

- Term Limits will bring diversity of people and fresh ideas to Congress.

Term limits for lawmakers: when is enough, enough?

[Editor's Note: If you want to get rich, i.e. advance from a low paying government bureaucrat job on the local or state level, THEN GET ELECTED TO THE US CONGRESS (House or Senate). Once you're elected, it's easy to steal from your campaign contributions or the Congressional budget allocated to your seat and staff. You can go on a government-funded junket with 'lavishly' paid expenses. The list of ways to steal from the government while in office is inexhaustible. There are only a few Congressmen who left Congress just wealthy instead of a multi-millionaire. Of course, there are several who arrived in Congress as multi-millionaires and don't need to steal from the government.]

|

|

***

Currently, the federal government spends about 23 percent of gross domestic product (GDP), and state and local governments spend approximately another 15 percent net of federal transfers. In 1948, federal and state governments spent roughly half as much of GDP as they do today. A hundred years ago, total government spending was less than 9 percent of GDP, and most was at the local level.

Evidence indicates that total government spending is at least twice as high as it should be to maximize job creation, economic growth and the general welfare.

Assume the United States has accumulated so much debt that bond buyers will no longer buy U.S. government bonds. Also assume that the present income tax structure has collapsed because of its size and complexity or that the Supreme Court returns to first principles and limits the federal government to doing only what is in the Constitution, leaving the rest to the states or the people (as specified by the 10th Amendment).

Either way, the federal government might be forced to cut its real spending in half or more from today's 23 percent of GDP to the 1948 level of 12 percent. Under such conditions, what type of tax system should be set up?

The Founding Fathers explicitly stated that the purpose of government was to protect person and property and ensure liberty. It was understood that government should do only those things the people could not do for themselves. In other words, the federal government provides for the common defense, the federal court system and not much else.

***

Chile pioneered a privatized and extremely successful social security program, which has been adopted in part or whole by 30-plus countries. Likewise, medical entitlements could be turned into true insurance programs — with higher deductibles and copayments for most people — and limited subsidies only for the truly needy.

Defense and the court system are the only truly significant "common goods" mandated by the Constitution. Many expenses of the court system could be funded by "user fees." Defense spending is to protect liberty, person, and property (like fire and auto insurance). The "protection of liberty and person" portion could be financed by a low-rate sales tax, which all people pay in proportion to their spending, and the "protection of property portion" could be paid for by a surtax on state and local real estate and business property taxes.

***

[Editor's Note: Repeal of the 16th Amendment (fraudulently ratified 1913 income tax amendment) and formalizing a Excise Taxes and User Fees use of government services by anyone. However, the feds DON'T work for the People.

With a Excise Taxes, User Fees, and a minimal Sales Tax, most government services (that anyone wants) could be financed without ripping-off the People. Defense and Courts could be financed with a combination of User Fees and a National Sales Tax (10%). EVERY item purchased by ANY ENTITY would pay sales tax. ONLY food, clothing, and shelter would be exempt. Liberals whine about 'fair share', this is the fairest share for everyone! No income tax would eliminate an estimated annual $10 billion in wasted effort reading, understanding, and complying with the 100,000 pages of convoluted trash called the tax code. Fed government revenues would be based on a THRIVING economy free of the former 'punishment for success'!]

|

|

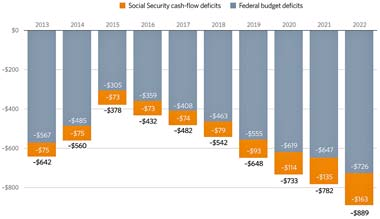

[Editor's Note: Citizens who have paid in to Socialist Insecurity (SS) all their lives vehemently protest any tampering with SS. However, SS was installed as a government program in 1935 when the world was in Depression. Franklin Roosevelt (FDR) could have passed a ham sandwich in those days. SS was and has been just another source of revenue for government scumbags. SS is a SOCIALIST program disguised as a "safety net". If government had established a PRIVATE retirement plan (like CONgress has for itself), SS would be solvent today and government couldn't ROB it like today.

Our 'mis-representatives' represent only themselves --- NOT their constituents! Mis-reps are on a power trip to gain more and more power over us. An informal historical study of the last 100 years with depression, recessions, world wars, 'police actions', and inflationary devaluation of the dollar (most of which was caused by government) shows that each event was used as an excuse to tighten the control over citizens.

Our mis-representatives have legislated themselves an increasingly larger slice of the economic pie while slowly destroying the private economy which provides their piece of the pie. Mis-representatives sit high above those who testify and make their photo-opportunistic speeches to impress the public and the suckers of America are impressed and vote for the best speech --- not the proof of a real representative's effort to downsize government and remove government intrusion from American life. Central Planning will INEVITABLY FAIL !

The government procedure for gaining complete, totalitarian control of a nation is first to make everyone dependent on government, either by supporting people financially or eliminating all choices except the government choice. Then, government can do anything it wants. These government clowns will succeed at one and only one thing: the government will cause the creation and expansion of a black market for all goods and services that will destroy the economy. Eventually, all citizens who can leave America will expatriate to a more favorable country. Government in this country was NEVER envisaged to consume 40% of the economy and NEVER meant to meddle in the lives of FREE people.

|

|

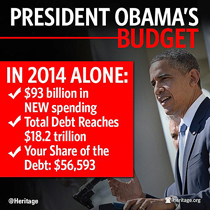

President Obama will release his overdue budget on Wednesday [4/10/2013]. It will doubtless project a reduction in the federal budget deficit—a projection that journalists, commentators and policy makers should ignore. To do otherwise is to be complicit in fraud. Strong statement? Not really.

For 50 years or so the federal government has deliberately and to an increasing extent misstated probable future budget deficits. Democrats and Republicans are guilty. The White House is guilty. And so is Congress. Private firms that deliberately misrepresent their financial statements in this fashion would be guilty of a crime.

The magnitude of the misrepresentation is breathtaking. For one example, the bitterly contested “fiscal cliff” legislation (the American Taxpayer Relief Act of 2012) raised the top income tax rate to 39.6%. However, the Congressional Budget Office’s latest (early February) deficit projection for 2013-22 is now $4.6 trillion higher than the baseline deficit it projected in mid-2012. After the tax increase, how can that be?

Easy. Congress requires the CBO to present its baseline budget projections on the basis of “current law.” Congress then manipulates current law to understate probable future outlays beyond the present year, and to overstate probable future revenues. These manipulations change CBO baseline budget projections based on current law. Voilà, actual deficits exceed projections, and the previous budget projections are rendered meaningless.

Congress can misrepresent the effects of any given piece of legislation in complex ways. It does not do so by entering, say, $800 million when the correct number is $900 million. Instead, Congress enacts certain tax and spending measures as “temporary” when it has no intention of allowing the provision to lapse; or it assumes legislative provisions in current law that would cut spending will be made, when Congress knows they never will.

[Editor's Note: I think the term "High Crimes and Misdemeanors" MUST be specifically defined to include, without limitation, all forms of "misrepresentation".]

|

Why? Why does the federal government SPEND so much money POLICING the WORLD? Why? Why don't other countries SPEND as much on THEIR MILITARY and THEIR NATIONAL DEFENSE as the US government does? Why does the federal government SUBSIDIZE foriegn military?

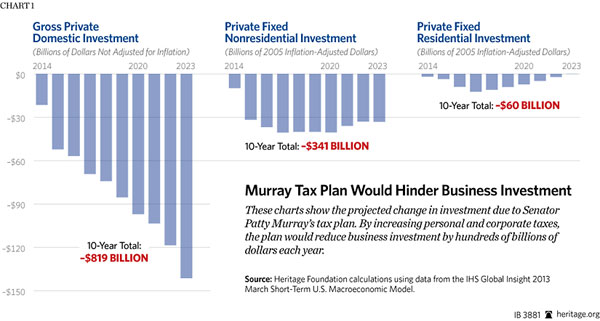

The following chart shows how the tax thievery of Patty Murray's Budget (led by Harry) will destroy private investment over ten years.

|

"The Consolidated and Further Continuing Appropriations Act" of 2013, funding for the bloated fed government.

|

|

Since CONgress supposedly holds the "purse strings" and If CONgress REALLY wants to redeem itself in the view of voters and correct the most dangerous runaway spending disaster in the history of the federal government, CONgress should NEVER increase the Debt Ceiling again and then DEFUND fifty (50) percent of all government departments, agencies, and programs because the Executive Branch will NOT cut spending by performing its required executive and managerial functions.

The bureaucrats and union bosses control America. The spending can ONLY be controlled and decreased by DEFUNDING all but the necessary departments.

It is a Keynesian FALLACY that reductions in government spending or eliminations of bogus, boondoggle departments will harm the economy. If our private economy were not so badly damaged by a taxing, intrusive government, even the most unqualified, terminated government employees could find employment tomorrow at Wal-Mart or McDonalds.

|

| Time to Shrink the Monster (watch 30 sec. video) |

|

How did the feds get to a

How did the feds get to a .png)

If the American people truly understood how the Federal Reserve system works and what it has done to us, they would be screaming for it to be abolished immediately. It is a system that was designed by international bankers for the benefit of international bankers, and it is systematically impoverishing the American people. The Federal Reserve system is the primary reason why our currency has declined in value by well over 95 percent and our national debt has gotten more than 5000 times larger over the past 100 years. The Fed creates our "booms" and our "busts", and they have done an absolutely miserable job of managing our economy. But why do we need a bunch of unelected private bankers to manage our economy and print our money for us in the first place? Wouldn't our economy function much more efficiently if we allowed the free market to set interest rates? And according to Article I, Section 8 of the U.S. Constitution, the U.S. Congress is the one that is supposed to have the authority to "coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures". So why is the Federal Reserve doing it? Sadly, this is the way it works all over the globe today. In fact, all 187 nations that belong to the IMF have a central bank. But the truth is that there are much better alternatives. We just need to get people educated.

If the American people truly understood how the Federal Reserve system works and what it has done to us, they would be screaming for it to be abolished immediately. It is a system that was designed by international bankers for the benefit of international bankers, and it is systematically impoverishing the American people. The Federal Reserve system is the primary reason why our currency has declined in value by well over 95 percent and our national debt has gotten more than 5000 times larger over the past 100 years. The Fed creates our "booms" and our "busts", and they have done an absolutely miserable job of managing our economy. But why do we need a bunch of unelected private bankers to manage our economy and print our money for us in the first place? Wouldn't our economy function much more efficiently if we allowed the free market to set interest rates? And according to Article I, Section 8 of the U.S. Constitution, the U.S. Congress is the one that is supposed to have the authority to "coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures". So why is the Federal Reserve doing it? Sadly, this is the way it works all over the globe today. In fact, all 187 nations that belong to the IMF have a central bank. But the truth is that there are much better alternatives. We just need to get people educated.